CAUTION: This article was first published in November 2016 and was updated in September 2017 January 2018. It offers a good overview of cryptocurrencies and related tech, but the field is changing continuously. Be sure to do your own research! Some of this information may be outdated by the time you read it.

As someone whose been working online since Y2K was a thing, I’ve had a chance to be part of an ever-changing landscape of cultural and technological change. One of the more interesting phenomenon I’ve had a chance to experience is the rise of the “decentralized digital currency”. For me, as for many others, it all started in the winter of 2013 when a little known virtual currency known as Bitcoin made its way into the mainstream news. In the fall of 2012 a single bitcoin had been worth about $10US, but by April of 2013 the price had surged to nearly $300. Many have concluded that the loss of Cyprus as an investment safe-haven was a catalyst for the rise of Bitcoin and the timing of Bitcoin’s rise does seem to support that theory. Regardless of the cause, Bitcoin had become a thing. At that time I took it upon myself to learn as much as I could about the world of Bitcoin (and it’s many imitators and successors) and did my small part to join in.

For brevity, my explanations are simplified, but I’ll provide some references at the end for those of you interested in digging deeper.

The first thing I learned about Bitcoin is that you can “mine” Bitcoins by running a program on a computer. The second thing I learned is that I shouldn’t do it.

What is Bitcoin?

The basic idea behind Bitcoin was that of an electronic currency that could be exchanged nearly as simply and anonymously as cash with minimal transaction fees and without control by a central bank or authority. It uses a public ledger known as a “blockchain” which records transactions in such a way as to avoid alteration, double spending and manipulation. The network is supported by computers running software that processes bitcoin transactions and participation in the network is rewarded by the creation of new “blocks” of bitcoins. This is what is referred to as “mining”. More on that later.

I thought Bitcoin went out of business? Or was hacked? Or shut down?.. Or whatever..

It’s surprising how many people believe that Bitcoin is no longer around. Quite the opposite is true, but there is no question that the Bitcoin “brand” has suffered some setbacks over the past few years. The failure of the Bitcoin exchange Mt Gox and the government shut down of the “darknet market” known as Silk Road were some of the more widely publicized events. In fact, there have been several major hacks of digital currency exchanges and markets over the past few years. There are also a number viruses and malware that require bitcoin as a ransom currency to unlock infected computers or are designed to mine digital currencies without user permission. The world of a digital currency is a veritable wild west. It reminds me of the internet in the late 1990’s.

Hmmm… Sounds Sketchy.

The first takeaway is that Bitcoin was designed to be digital cash. And like cash it can be used for anything, by anyone. Also like cash, you shouldn’t leave it lying around. Companies handling large volumes of digital currencies have learned some hard lessons about security over the past few years as have many individual investors. Back to that wild west comparison again: You don’t hear much about bank robberies anymore, but there was a time…

If it’s Cash then How do I Buy or Sell it? Or Shop with it?

There are a number of companies that offer merchants, individuals and investors the opportunity to buy and sell Bitcoins using traditional currency and integrate Bitcoin with business payment systems. The are also a number of exchanges where speculators and other market participants may exchange Bitcoin for other digital currencies and for traditional currencies. Many merchants now also accept bitcoin and other coins as direct payment for goods and services. We list some of these at the end of this article. Your ability to (easily) buy or sell bitcoin or other digital currencies may depend on where you live since laws vary by country and region. Do your research.

Becoming a Miner

Back to my story. The first thing I learned about Bitcoin is that you can “mine” Bitcoins by running a program on a computer. The second thing I learned is that I shouldn’t do it.

You see, in order to maintain value one must limit supply, and Bitcoin limits supply by decreasing the number of coins that are rewarded from mining over time. In addition, the “difficulty” of finding a block also increases over time. By the time most of us found out about Bitcoin, it was far too difficult to mine any from a home computer without spending more on power than one could gain. By the spring of 2013 several companies were offering specialized Bitcoin mining machines (ASICs, or Application-Specific Integrated Circuits) that were far more efficient and powerful than any personal computer. These caused difficulty to skyrocket even further and an ongoing “arms race” of continuously improving ASICs has forever pushed hobby miners out of the fray.

Luckily, there was another way. Bitcoin, I found out, was not the only digital currency. In fact there were dozens of others. Some were straight copies of the Bitcoin code, but others were designed using different algorithms for which powerful ASICs were not publicly available. Initially, the most popular of these was Litecoin. Based on my calculations at the time, a decent computer could mine enough to Litecoin to pay for itself in 2 to 3 months. I decided it wouldn’t be a huge risk or investment to build a dedicated mining computer. It would allow me to play an active role in supporting the digital currency networks and I had a new computer to use elsewhere if my experiment failed.

Building My Miner

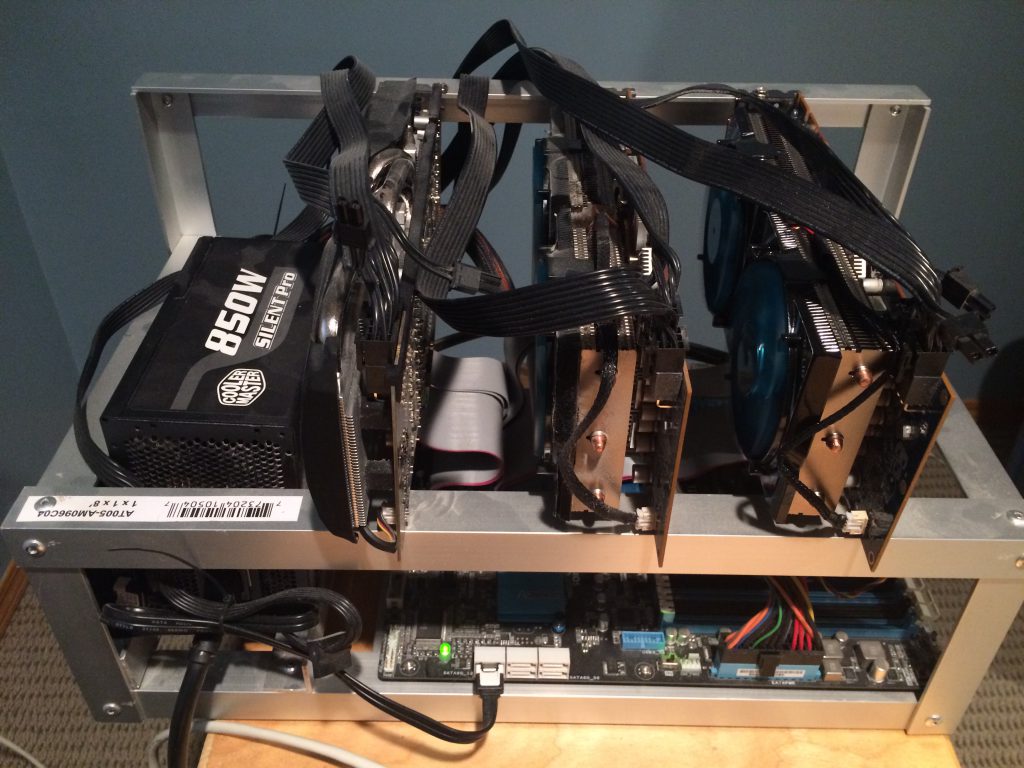

Since the mining software was designed to run on GPUs (graphics cards) I set out to build a computer that included 2 higher-end ATI graphics cards and a power supply strong enough to run the GPU at 100%. That made up the bulk of the cost. The CPU, RAM and hard drive were all fairly basic and the only features I really needed from the motherboard was support for multiple graphics cards.

Once it was running I quickly realized I needed to find a way to cool it down and built an open-air aluminum frame to hold the entire unit. After a few months I also added a third graphics card. So while it looks high-tech, it’s really just a computer mounted on aluminum angle brackets from Home Depot. The unit is controlled by TightVNC from another computer on our home network so no keyboard or mouse is needed.

The software set-up can vary depending on your needs and preferences. I use Windows but you could easily install your preferred flavor of Linux. Each coin has it’s own wallet software and many have third party mining software available.

Let’s Mine!

While mining involves running software and doing “work” for the network, there is no guarantee that doing work will result in a reward of coins. There is an element of luck involved. If you’re lucky you might find a block of coins every so often, but you could also go weeks, months or even years without a reward depending on the power of your computer. In order to reduce risk and minimize the “luck” factor, many miners join pools. With pool mining you do work for the pool and the pool collectively shares any rewards generated minus a small fee for the operator (usually 1-2%). Large pools may have hundreds or even thousands of miners working for them and as a result they find blocks regularly and consistently. Every miner who contributes to the pool get a share of the reward proportional to the amount of work they contributed. This results in consistent regular, albeit smaller payouts for any given miner. It’s also possible with some pools and coins to mine directly to an exchange and/or automatically convert mined coins to Bitcoin. For me a pool is the logical choice. I’ll list some of my favorites at the end of this article.

Let’s Bail!

I mined Litecoin for a little more than a year before I jumped ship. During that time the price of Bitcoin rose for the first time to more than $1000 and Litecoin was carried along to about $50. It was an exciting time in digital currency and many new players started paying attention. In the spring of 2014, the first ASICs for Litecoin (and similar coins using the “Scrypt” algorithm) were made publicly available and the coin began a slow decline caused by increasing difficulty and too little demand or adoption.

I actually purchased one of the new ASICs when they first came out and had it running for about 6 months before it became unprofitable. This was a hard lesson in bad math. Initially it was mining at more than 3x the rate of what my computer was doing for about 1/3 of the power. Good times. But everyone had one. And better ASIC’s quickly followed pushing up the difficulty on the network and decreasing the rewards. In the end it probably never paid for itself and it now sits in the back of a closet, while my little PC miner hums along printing magic internet money.

Even with the increase in the value of Litecoin in 2017, the proliferation of ASICs has pushed the mining difficulty up so high that, like Bitcoin, it is not feasible to profitably mine with a PC.

Let’s Mine (Again)!

The good news is that there are still profits to be made for PC miners. New digital currencies and “tokens” are continuously being released and the fear of missing out on the next big thing keeps speculators buying these new coins. This gives miners the opportunity to point their machines towards profitable networks. And there’s always the chance that the latest Altcoin could actually gain wide-scale interest and increase in value. Mined coins can be bought or sold for Bitcoin and other digital currencies or cash using online digital currency exchanges. I list some of the exchanges and the more recently popular and profitable coins at the end of this article.

(It’s worth noting here that the rise of the Altcoin and unregulated digital currency exchanges has created a whole new breed of digital pump-and-dump scheme. Do your research before jumping on an Altcoin bandwagon. Some resources are listed at the end.)

What’s New Under the Sun?

I have continuously mined one coin or another since I first built my miner in 2013. During that time I have mined more than a dozen coins, most of whose names I forget. While many Altcoins have come and gone, my long time favorite and personal bet for “next big thing” is Monero.

Monero has two important features that Bitcoin doesn’t have: Scaleability and Anonymity. Despite what many had believed, transactions on the Bitcoin network are not anonymous and a number of new coins, including Monero, have sought to address a demand for better privacy. In addition, Bitcoin wasn’t designed to scale up beyond specified preset limits. This has resulted in slower transactions, increased fees and a “bloated” blockchain which many argue is hindering wider adoption. Bitcoin is still the most valuable and most widely traded digital currency, but one gets the feeling that it is destined to remain more of an asset, like gold, rather than expand to wider adoption as a true digital currency. Monero was designed to be scalable and fully anonymous. It’s not quite as user-friendly as it could be, but there is continuous work on it’s core software by dedicated volunteers and donation-supported programmers. Of the many coins I’ve mined it’s one that I’ve (mostly) chosen to hang on to.

But that’s just me. You need to do your own research and decide what’s worthy of your attention. In the world of digital currencies and blockchain technology there is constant development and innovation. There is also a constant flow of bad information and outright lies. Much of the time it can be hard to tell the difference. One thing is for certain though: There is opportunity. Such is life in the wild west.

Further Reading

Bitcoin and Blockchain

Basic information and some links to larger resources.

- Bitcoin (Official Site)

- What is Bitcoin? (Coindesk: A good Bitcoin-centric news site)

- Why cyber currency Bitcoin is trading at an all-time high (CNN Money, March 2013)

- What is a blockchain, and why is it growing in popularity? (Arstechnica)

- Bitcointalk (Forum) This site is a massive resource of user discussions on Bitcoin and Altcoins. You will find everything about digital currencies here, both good in bad in all it’s unedited glory. If you’re serious about jumping in you should be prepared to spend a lot of time here.

Stories and Scandals

Some interesting stories of big hacks, fails and lessons learned. If you learn anything from these links it’s that you shouldn’t leave any significant quantity of digital currency with any online exchange or company.

- Mt Gox: The History of a Failed Bitcoin Exchange (Coindesk)

- Silk Road: The Untold Story (Wired)

- The Bizarre Fallout of Ethereum’s Epic Fail (Fortune)

- Cryptsy bitcoin exchange announces massive theft and shuts down… (Bitcoin.com)

- A Timeline: ShapeShift Hacking Incident (Shapeshift)

- The $65 million Bitfinex hack … (Quartz)

- Alphabay: The Biggest Dark Web Takedown Yet Sends Black Markets Reeling (Wired)

- NiceHash CEO Confirms Bitcoin Theft Worth $78 Million

Digital Currency Exchanges and Trading

- CoinMarketCap: This site offers a good overview of the current state of the digital currency markets and the various coins that are traded.

There are many digital currency exchanges, most with terrible names. These are a few that I am more familiar with:

- Poloniex: US-based. Good selection of Altcoin and major trading pairs, but cannot withdraw USD or other traditional currencies. Also has margin trading and lending.

- Kraken: US-based. Limited selection of coins, but you can sell Bitcoin for USD, CAD, EUR or GBP or JPY.

- QuadrigaCX: Canadian-based. Limited coin selection, but allows withdrawal of CAD.

- Bittrex: Smaller exchange with some of the more obscure Altcoins as well as the majors.

- Bithumb: High volume Korean-based Exchange

These sites are not exchanges, but can be used to buy or sell digital currencies:

- Coinbase: US-based. Offers merchant integration and USD withdrawal.

- Shapeshift: Offers direct buying and selling of digital currencies, but not traditional currencies.

Altcoins

Some of the currently popular (as of September 2017) Altcoins that can be mined from a PC and some other good reading.

- An Investor’s Investigation Into The Mining Statistics Of Bitcoin Alternatives (devtome.com): This document is *old*, but it’s a very well researched and worth a read.

- Monero (official)

- Ethereum (official)

- Ethereum Classic (official)

- ZCash (official)

Every Altcoin will have it’s own thread on Bitcointalk and on Reddit. Some may have standalone forums as well. Look around.

Mining and Miners

- What to Mine: A good overview and comparison of currently mineable coins.

- Altcoin Mining (Bitcointalk): A somewhat messy, but informative list of discussions on Altcoin mining. Each coin will have it’s own sub-thread and probably a mining thread so be sure to search around.

- DwarfPool.com: One of the largest pools for both Monero and Ethereum

- MineXMR.com: A Monero mining pool with a list of other Monero Pools.

NiceHash: You can sell or buy “hashing power” for various coins from miners attached to their network. Get paid in Bitcoin. They also have some easy to use mining software that integrates with their system.Nice hash recently got robbed and their status is uncertain. See the story link above.

Security

A few resources on keeping your digital currency safe.

- Securing your [bitcoin] wallet (bitcoin.org)

- How to Make a Paper Bitcoin Wallet: Ironically, one of the best ways of securing your digital currency is to keep it off of a computer. (coindesk.com)

- An extensive guide for securely generating an offline cold paper wallet: This is a super-paranoid detailed guide for putting your Monero wallet into offline “cold storage”, but the same basic principles can apply to most any Altcoin. (Reddit)

- Ledger Wallet: The latest and greatest in secure Bitcoin wallets. Trezor is a standalone device designed to securely protect your Bitcoin (and some other Altcoins) wallets while still making access easy.

- Trezor: Another secure “hardware wallet”. Trezor is a standalone device designed to securely protect your Bitcoin wallet (and some other Altcoins) while still making access easy.

About Me

I’m a web developer and internet marketer and this is my website. Please feel free to contact me if you’d like to discuss this article or any of my company services.